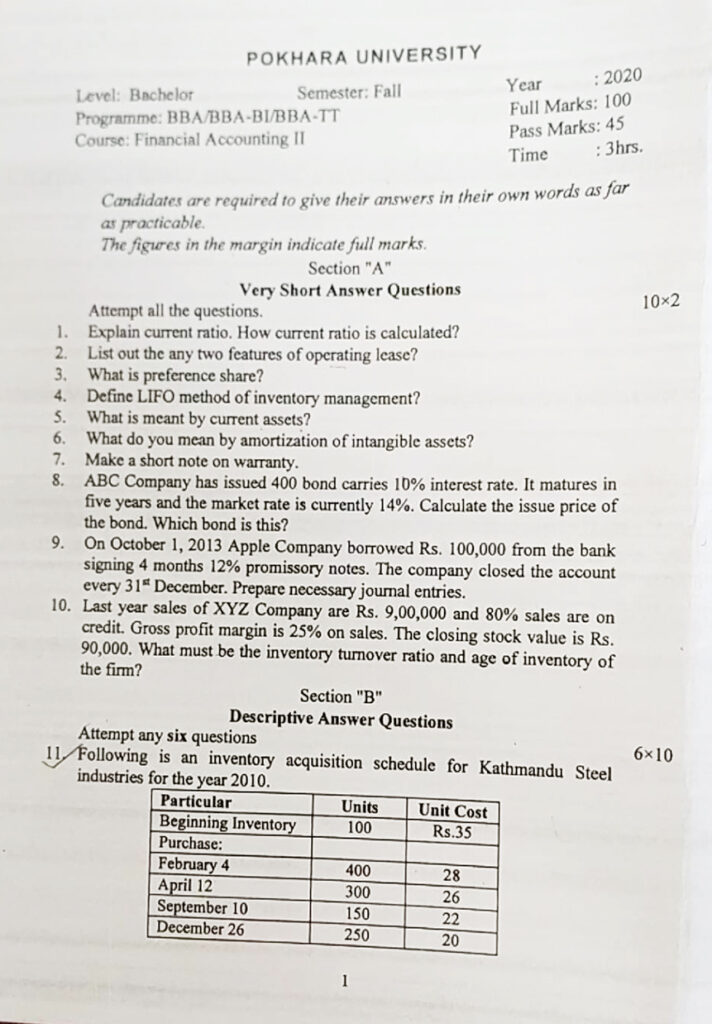

This is the question asked in financial accounting 2nd second semester BBA/BBA-BI/BBA-TT on the final exam by the Pokhara university on 2020 AD. This article also includes the picture of question paper-2020 so our user have no confusion or misunderstanding on Ezi-Learning

Pokhara University

Level: Bachelor

Programme: BBA/BBA-BI/BBA-TT

Course: Financial Accounting

Semester: Fall

Year: 2020

Full Marks: 100

Pass Marks: 45

Time: 3hrs

Candidates are required to give their answer in their answer in their own words as far as practicable.

The figures in the margin indicate full marks

Section “A”

Very Short Answer Questions

Attempt all the questions:

- Explain the current ratio. How current ratio is calculated?

- List out any two features of the operating lease?

- What is preference share?

- Define the LIFO method of inventory management?

- What is meant by current assets?

- What do you mean by amortization of intangible assets?

- Make a short note on warranty?

- ABC company has issued 400 bond carries 10% interest rate. It matures in five years and the market rate is currently 14%. Calculated the issue price of the bond. Which bond is this?

- On October 1, 2013 Apple Company borrowwed Rs. 100,000 from the bank signing 4 months 12% promissory notes. The company closed the account every 31st December. Prepare necessary journal entries.

- Last year sales of XYZ company are Rs. 900,000 and 80% sales are on credit. Gross profit margin is 25% on sales. The closing stock value is Rs. 90,000. What must be the inventory turnover ratio and age of inventory of the firm?

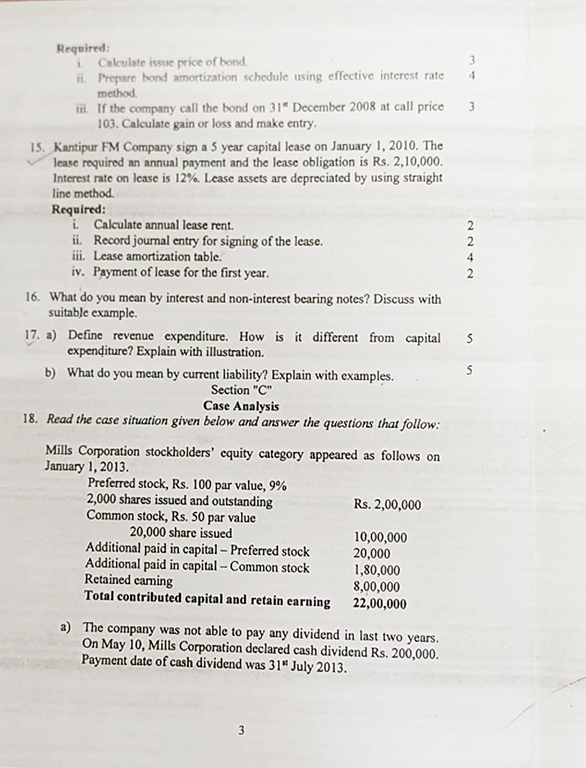

Section “B”

Descriptive Answer Questions

Attempt any six questions

11. Following is any inventory acquisition schedule for Kathmandu Steel industries for the year 2010.

| Particular | Units | Unit Cost (Rs.) |

| Beginning Inventory | 100 | 35 |

| Purchase: | ||

| February 4 | 400 | 28 |

| April 12 | 300 | 26 |

| September 10 | 150 | 22 |

| December 26 | 250 | 20 |

During the year, Kathmandu Steel sold 900 units @ Rs. 60each each. All expenses except cost of goods sold and taxes are amounted to Rs. 90,000. The tax rate is 20%.

Required:

- Compute cost of goods sold and ending inventory. Under each of the following two methods i) FIFO ii) LIFO

- Prepare income statements under each of the two methods.

- which method do you recommend so that Kathmandu Steel pays the least amount of taxes during 2010? Explain your answer.

12. During the year of 2011, K and K company made total sales of Rs. 400,000 of which 80% are on credit. The Company collected cash of Rs. 170,000 from the open account in that year. In the year, 2011, it wrote off Rs. 4000 as an uncollectible account. The following are balances of accounts at the end of 2010.

Account Receivable Rs. 20,000

Allowance for doubtful debt Rs. 3,000 (Cr.)

Company’s past performance shows that 10% of its ending balance of account receivable is expected to be in doubtful debts.

Required:

- Journal entries for sales, collection, and write-off of uncollectible accounts.

- Estimate the bad debts expenses for 2011 based on the percentage on account receivables also journalize it. In April 2011, debtor who has been already written off its debts of Rs. 1,500. Prepare the journal entries for bad debts recovered.

13. On July 1, 2002 Bata Company purchased a machine at a cost of Rs. 9,00,000. Related expenses are VAT Rs. 1,00,000, Custom charge of Rs. 15,000. Insurance from Calcutta Port to Kathmandu Rs. 18,000, 3-year fire insurance policy of Rs. 25,000.

Required

- Prepare necessary journal entries for the above transaction on July 1, 2002.

- Prepare journal entries for depreciation on December 31, 2002, and December 31, 2003, assuming that the life machine is 8 years and straight line with Rs. 50,000 salvage value.

- Prepare journal entries for depreciation on December 31, 2002, and December 31, 2003, assuming that the rate of depreciation charged by the company is 20 on the written down value method.

14. Nepal SBI Bank issued 12% five year bond with a face value of Rs. 1000 each on 1st Jan 2007. Interest is paid annually on each 31st December. The money market rate is currently 8%.

Required:

- Calculate issue price of bond.

- Prepare bond amortization schedule using effective interest rate method.

- If the company call the bond on 31st December 2008 at call price 103. Calculate gain or loss and make entry.

15. Kantipur FM Company sign a 5 year capital lease on January 1, 2010. the lease required an annual payment and the lease obligation is Rs.210000 . interest rate on lease is 12% .lease asset are depreciated by using straight line method.

Required;

- Calculate annual lease rent.

- Record journal entries for signing of the lease.

- Lease amortization table.

- Payment of lease for the first year .

16. What do you mean by interest and non-interest bearing notes? discuss with suitable example.

17. a) Define revenue expenditure. how is it different from capital expenditure? explain with illustration.

b) What do you men by current liabilities? explain with example.

Section “C”

Case Analysis

Read the case situation given bellow and answer the question that follow:

Mills corporation stockholders’ equity category appeared as follows on January 1, 2013.

Preferred stock , Rs.100 par value ,9% 2000 share issued and outstanding Rs.200000

Common stock , Rs.50par value 20000 share issued Rs.1000000

Additional paid-in capital -preferred stock Rs.20000

Additional paid-in capital -common stock Rs. 180000

Retained earning Rs.800000

Total contributed capital and retained earning Rs.2200000

a) The company was not able to pay any dividend in last two years . on may 10, mills corporation declared cash dividend Rs 200000. payment date of cash dividend was 31 July 2013.

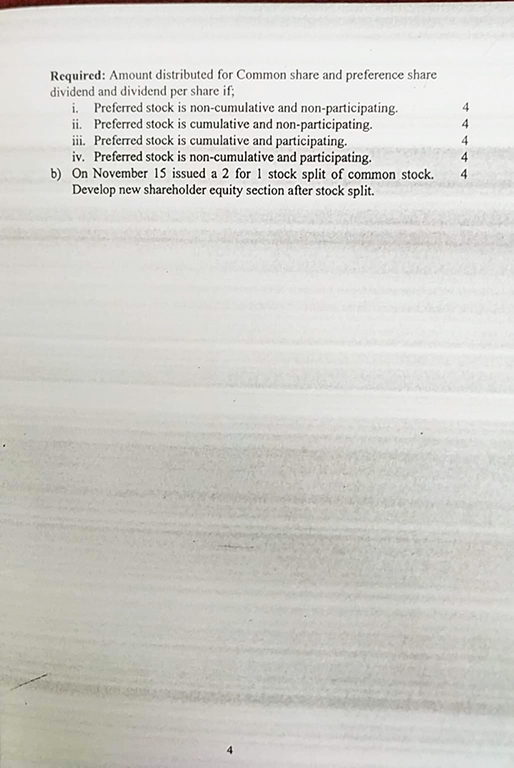

Required; Amount distributed for common share and preference share dividend and dividend per share if:

- Preferred stock is non- cumulative and non-participating.

- Preferred stock is cumulative and and-participating .

- P.referred stock is cumulative and participating .

- P.referred stock is non -cumulative and participating.

b) On November 15 issued a 2 for 1 stock split of common stock .develop a new shareholder equity section after the stock split.

Here I put the picture of question paper to make our users believe;

Click below to download the question paper asked in exam 2020 (BBA/BBA-BI/BBA-TT) on second semester.